Home » Company Overview

Provide innovative financial and industrial ASSET SOLUTIONS through the most diverse circumstances

OUR VISION

Be the global leader in tailoring unrivaled ASSET SOLUTIONS, as we continue to facilitate the conversion from a linear to a circular economy

Heritage Global Inc. (NASDAQ: HGBL) is a renowned asset-based market maker which provides result driven solutions to industrial & financial institutions through its two main business units: Industrial Assets and Financial Assets. The synergy between these two business units defines the “Legacy of Asset Solutions” dating back to 1937.

Industrial Assets

Defined through three revenue streams:

Heritage Global Partners (“HGP”)

Heritage Global Valuations (“HGV”)

American Laboratory Trading (“ALT”)

Financial Assets

Defined through two revenue streams:

National Loan Exchange (“NLEX”)

Heritage Global Capital (“HGC”)

A LEGACY OF LEADERSHIP FOR OVER 80 YEARS

OUR HISTORY

1937

Ross Mercantile Company Founded

It all starts in 1937 as Harry Ross establishes “Ross Mercantile Company“ in a small warehouse in San Francisco. His goal is to only service the local clientele. Harry, a former boxer, works hard and builds a solid reputation in the city by the Bay.

1951

Ross-Dove Company

Harry’s son-in law, World War II veteran Millard Dove, joins the Ross Mercantile Company. As a result of their alliance, “Ross-Dove Company” is born. Harry and Millard are known for running a successful and well-respected regional firm with a handshake. Their promise: “Always treat the customer with kindness, respect, and above all, dignity.“

1955

Central Eureka Mine Auction

A public auction by Harry Ross and Millard Dove for the Central Eureka Mine in Amador County, CA. See “Gigantic Public Auction Sale“ ad.

1959

Beale Air Force Base Auction

Ross-Dove Company conducts the first surplus auction for the United States General Services Administration. See “Government Sale“ ad.

1962

Government Land Auctions

Ross-Dove Company conducts record land auctions for the United States General Services Administration.

1980

Ross Dove Joins Ross-Dove Company

Millard’s oldest son Ross Dove joins the family business to help carry on the legacy.

1984

Osborne Computer Company Sale

Ross-Dove Company conducts landmark sale of Osborne Computer Company. See “Osborne on the block“ article.

1984

Kirk Dove Joins Ross-Dove Company

Millard’s younger son Kirk Dove joins his brother (Ross) to carry on the family legacy.

1985

XEROX Auction

Xerox Corporation contracts with Ross-Dove Company to auction over 20 million dollars in new personal computers and printers. See “Computer world focusing on Xerox’ new PC“ article.

1986

Auctioneering becomes Big Business

A back-roads practice gets on the expressway as the Ross-Dove Company continues to get the best prices for its client’s assets. See “Big businesses are sold on fast cash of auctions“ article.

1986

Rojon Electronics Auction

Ross-Dove Company is hired by Rojon Electronics, Inc. to sell the assets in Poughkeepsie, NY. See “Rojon’s final assets put on the auction block“ article.

1987

Celebrating 50 Years

Ross-Dove Company celebrates 50 years in the auction business and is recognized by the largest brands and corporations to conduct auctions. See “Brothers making millions from auctioning computers“ article.

1987

Mindset Corporation Auction

In 1984, Mindset Corporation was the toast of Silicon Valley and in 1987 its assets hit the auction block to be sold by Ross-Dove Company. See “Mindset Corp. Goes Under the High-Tech Gavel“ article.

1988

Decision Industries Auction

Ross-Dove Company conducts an auction for Decision Industries of Horsham. See “How will it look in the den?“ article.

1989

Financial Assets Inception

Ross-Dove Company launches a division to create an open market for distressed financial assets. The division will later (in 1998) be registered as National Loan Exchange, Inc., nicknamed “NLEX“. The financial assets that will go to auction will include: real estate, consumer credit, student and automobile loans, credit card accounts and equipment lease portfolios.

1989

FDIC Auction of Financial Assets

Ross-Dove Company conducts an auction of loans acquired through Federal Deposit Insurance Corp. (“FDIC“) bank closings in Kansas, Missouri and Nebraska. The package includes performing and non-performing loans of all types, ranging from real estate and commercial to energy loans. See “Agency to sell loans from bank closings“ article.

1989

Liberty Service Corp. Auction of Financial Assets

Ross-Dove Company conducts the largest distressed financial asset auction consisting of $200M+ in credit card portfolios, consumer finance and FDIC Assets. See “America’s largest distressed financial asset auction“ ad.

1990

Drexel Burnham Lambert Auction

Ross-Dove Company conducts historic auctions for Drexel Burnham Lambert. See “Going From Drexel’s offices onto the auction block“ article.

1991

General Dynamics Auction

Ross-Dove Company auctions everything from Apple II computers and office desk to thousands of pounds of titanium and a $2-million robotics assembly line. See “Companies Increasingly Turn to Auction Block“ article.

1991

Resolution Trust Corporation (“RTC“) Auction

Ross-Dove Company conducts the auction of 175 Commercial real estate properties for the Resolution Trust Corporation. The properties, spread through 24 states, with an average value of $2.5M. See “RTC prepares for record auction“ article.

1991-1992

Largest FDIC Auction

Ross-Dove Company conducts the world’s largest auction sale for the FDIC. See “A piece of the auction“ article.

1993

Apple Auction

Ross-Dove Company conducts multimillion dollar auction sales for Apple, Inc.

1993

Mycro-Tek Bankruptcy Auction

The bankrupt computer-systems developer had plenty of trouble selling products but assets sold fast and furiously, frequently at premium prices at the auction conducted by Ross-Dove Company in March of 1993. See “Bidding war“ article.

1995

Koll-Dove Formed

Investors acquire interest; Company’s name changes to “Koll-Dove”.

1995

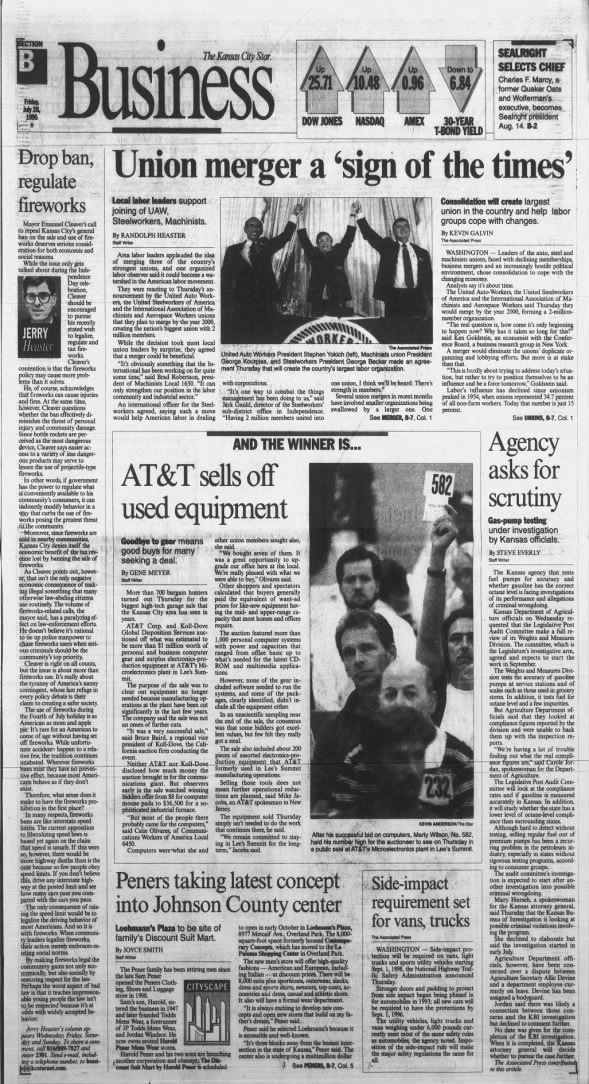

AT&T Auction

Koll-Dove conducts auction for AT&T Corp. for an estimated $1M worth of personal and business computer gear and surplus electronics and more. See “AT&T sells off used equipment“ article.

1995

Dali Art Fraud Auction

Koll-Dove conducts auction for lithographs and other officially “Faux“ Salvador Dali works that were part of a notorious art fraud case from Hawaii. See “Con artists“ article.

1997

Dove Brothers Formed

Ross and Kirk Dove re-acquire the firm and change the name to “Dove Brothers”. During their tenure at Dove Brothers, Ross and Kirk build acceptance of the auction industry by the world’s largest companies. The techniques and strategies they develop are unique to the industry and far ahead of their time.

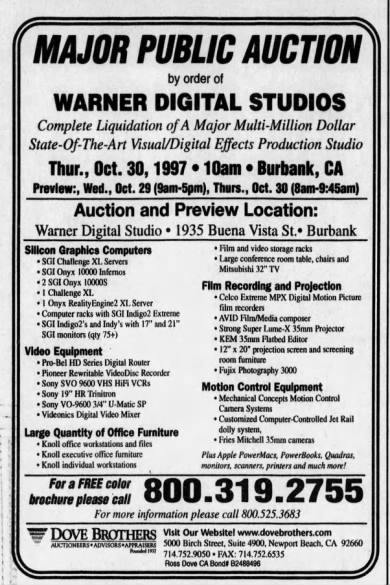

1997

Warner Digital Studios Auction

Dove Brothers conducts a complete liquidation of a Major Multi-Million Dollar State-of-the-Art Visual/Digital effects production Studio.

1998

Micropolis Auction

Dove Brothers conducts two major auctions, one in Bangkok and the other in Singapore for Micropolis in Creditors’ voluntary liquidation.

1998

National Loan Exchange, Inc. (“NLEX“) Registered

The Financial Assets division is registered in Delaware as National Loan Exchange “NLEX“ and conducts KARS YES FINANCIAL auction on August 12, 1998.

1998

Sid & Marty Krofft Auction

Dove Brothers conducts an auction for part of the Sid & Marty Kroffts’ world. See “Place a bid on a well-loved TV memory“ article.

1999

Raytheon Auction

Dove Brothers conducts an auction for Raytheon (a plant which made electronic components for the defense industry) with 700 lots, including items from machine shops, office furniture, data processing equipment, and electronic test equipment. See “In closing days, Raytheon auctions equipment“ article.

1999

DoveBid, Inc. Launched

Ross and Kirk’s early pioneering of asset management and cross border marketing has seen countless efforts at duplication over the decades that followed. As early adopters of the Internet, in 1999 they re-brand the business to “DoveBid, Inc.”

1999

Early Pioneers of Webcast Auctions

Dove Brothers develop the technology to broadcast their own auctions over the internet, combining the bidder’s voice thru a daily bridge phone line, while internet bidders simultaneously viewed the assets on their computers. The technology was developed in collaboration with Quest Communications. While watching the assets pop up on the website, off-site buyers would use their phone keypads to bid; pressing 1 to bid and 2 to pass. This was revolutionary since people no longer needed to travel to the auction site to place a bid.

2000

Ross Dove Featured on Forbes Global 2000 Cover

Forbes Magazine’s Global 2000 features Ross Dove as one of the “Twelve Titans Forcing the Web to Grow Up“.

See “Ross Dove – Infuse the Web into Your Firm”… Read More

2000

Dot-com Era

Ross and Kirk raise over $100M in venture capital from Silicon Valley’s preeminent firms. The innovative spirit of the Dove brothers leads to many of today’s industry standards, including online auctions, webcast auctions, email campaigns, SEO, and virtual auction marketing, among other countless developments. Ross and Kirk are true pioneers of the industry.

2001

Xerox Inkjet Auction

DoveBid sells 15,000 items that relate to Xerox’s inkjet plants, including the company’s entire 52,000 sq. ft. inkjet parts factory in Dundalk, Ireland. See “Dovebid auctioning Xerox inkjet assets“ article.

2002

Enron Auction

DoveBid conducts series of multi-million dollar auctions of Enron’s assets, including the Big “E“ which sells for $44,000. See “Pieces of crumbled Enron go to auction“ article.

Aura of Enron brings out high bidders at auction… Read More

2004

Longview Aluminum Auction

DoveBid conducts the Longview Aluminum auction of 4,000 items to raise money for the bankruptcy trustee who will use the funds to pay off creditors. See “Bidders snap up smelter commodities at auction“ article.

2004

Factory Closures in the United States

DoveBid conducts some of the largest factory closure auctions as businesses move their factories overseas. See “Industrial auctioneers’ stocks rise“ article.

2008

GoIndustry Acquires DoveBid

DoveBid is acquired by GoIndustry and changes name to “GoIndustry-DoveBid Inc.”

2009

Heritage Global Partners (“HGP”)

Ross and Kirk depart GoIndustry-DoveBid, Inc. and the family legacy is re-launched as “Heritage Global Partners, Inc.” Their promise: “To bring world leading best practices, technology, strategy, execution and results to the marketplace.“

2009-2012

Next Generation

A new generation of Dove’s join the family business to carry on the legacy.

2010

Amgen, Inc. Auctions

HGP conducts first auction for Amgen, Inc. (75+ to follow).

Click HERE to see a list of current auctions.

2011

Heritage Global Valuations (“HGV”)

Heritage Global Partners expands by launching Heritage Global Valuations, a valuation division for commercial & industrial assets including inventories and M&E.

2011

Amway Arena Auction

HGP conducts the Amway Arena auction selling all assets including seats and player lockers. See “You can own a piece of old arena“ article.

2011

Honolulu Symphony

HGP conducts the Honolulu Symphony auction selling two concert grand pianos, expertly maintained and used by some of the greatest artists in the world. A harpsichord. A set of timpani, a snare with flare, a set of sacred pahu drums, a room full of sheet music, much of it the work of the islands’ top musicians and thousands of other items. See “Symphony FOR SALE“ article.

2011

Solyndra Auction

HGP conducts yet another historical auction, Solyndra’s bankruptcy auction. See “Collapse of solar firm Solyndra is tale of too much dazzle“ article.

2012

Counsel RB Capital, Inc.

Heritage Global Partners is acquired by Counsel RB Capital, Inc., (OTCBB: CRBN) a division of Counsel Corporation.

Counsel RB Capital Adds Internal Auction Capability with Purchase of Industry Leader, Heritage Global Partners

WHITE PLAINS, N.Y. & TORONTO--()--Counsel RB Capital Inc. (OTCQB: CRBN) ("Counsel RB" or the "Company"), a leader in distressed and surplus capital asset transactions, today announced that it has completed the acquisition of Heritage Global Partners, Inc., ( http://www.hgpauction.com/) a leading, full-service, global auction and asset advisory firm managed by Ross and Kirk Dove.

2012

Digital Domain Auction

HGP conducts an auction for Digital Domain selling more than 1,000 items. See “Digital Domain a hit at auction“ article.

2013

Pfizer, Inc. Auctions

HGP conducts first auction for Pfizer, Inc. (100+ to follow).

Click HERE to see a list of current auctions.

2013

Heritage Global Inc. (“HG”)

Counsel RB Capital Inc. is re-branded: “Heritage Global Inc.” is born. Stock symbol switches to HGBL.

2013

America’s Cup Auction

HGP conducts series of auctions to sell surplus assets to the conclusion of the World Renown 2013 America’s Cup Race.

2014

Canadian Securities Exchange (CSE: HGP)

Heritage Global Inc. lists shares on the Canadian Securities Exchange (“CSE”).

2014

National Loan Exchange, Inc. (“NLEX”) Acquired Back

Heritage Global Inc. acquires National Loan Exchange, Inc. (north America’s leading charged-off consumer receivables broker) back into the Heritage Global family from David Ludwig who remains the president of the NLEX revenue stream.

2014

Counsel Corporation Dividend

Counsel Corp. dissolves its ownership in Heritage Global Inc. by dividending its shares out to Counsel Corporation shareholders.

2014

Candlestick Park Auction

HGP conducts a historic auction of the Candlestick Park.

You Can Literally Bring Home a Piece of Candlestick Park… Read More

2015

New Leadership

Heritage Global Inc. Appoints Ross Dove as CEO and Kirk Dove as president and COO.

2016

Sanofi Auction

HGP and partners conduct Sanofi Auctions.

Guess who bought this giant old Marion Labs plant… Read More

2018

Par Pharma Campus Auction

HGP and Investor Group acquire Par Pharma Campus which sells through series of auctions.

2018

Redhook Brewery Auction

HGP and partners conduct famous Redhook Brewery auction.

Redhook Brewery’s Woodinville Facility Heads to Auction… Read More

2019

Heritage Global Capital (“HGC”)

Heritage Global Inc. launches “Heritage Global Capital” to provide specialty financing solutions to small and medium sized investors in charged-off and nonperforming financial asset portfolios and other asset-based classes.

2020

Nasdaq Stock Market LLC (NASDAQ: HGBL)

Heritage Global Inc. announces approval of uplisting to the Nasdaq Stock Market LLC.

2020

Industrial and Financial Business Units Formed

Nick Dove, formerly Executive Vice President of HGP, is promoted to President of the Industrial Assets business unit, while David Ludwig, previously President of NLEX, is promoted to President of the Financial Assets business unit.

2021

American Laboratory Trading (“ALT”)

Heritage Global Partners acquires “American Laboratory Trading”, one of the largest suppliers of premium refurbished lab equipment in North America and a key provider of surplus asset services for the life sciences.

2021

Halliburton Auctions

HGP conducts first auction as part of a master service agreement with Halliburton.

Click HERE to see a list of current auctions.

2022

New Brand Launch

Nasdaq congratulates Heritage Global Inc. on its new brand launch!

2023

X Auction

HGP conducts a highly publicized auction with over 29,500 registrants for X.

Click HERE to see a list of current auctions.

Present

Legacy of Asset Solutions

Heritage Global Inc. (NASDAQ: HGBL) is a renowned asset-based market maker which provides result driven solutions to industrial & financial institutions through its two main business units; Industrial Assets and Financial Assets. The synergy between these two business units defines the “Legacy of Asset Solutions” dating back to 1937.